Paperwork and manual processes are old school when it comes to handling current customer processes. One of these is insurance claims processing, which is also a pain point for the industry. With conversational AI, not only can you boost your management over time, but it can also enhance the customer experience.

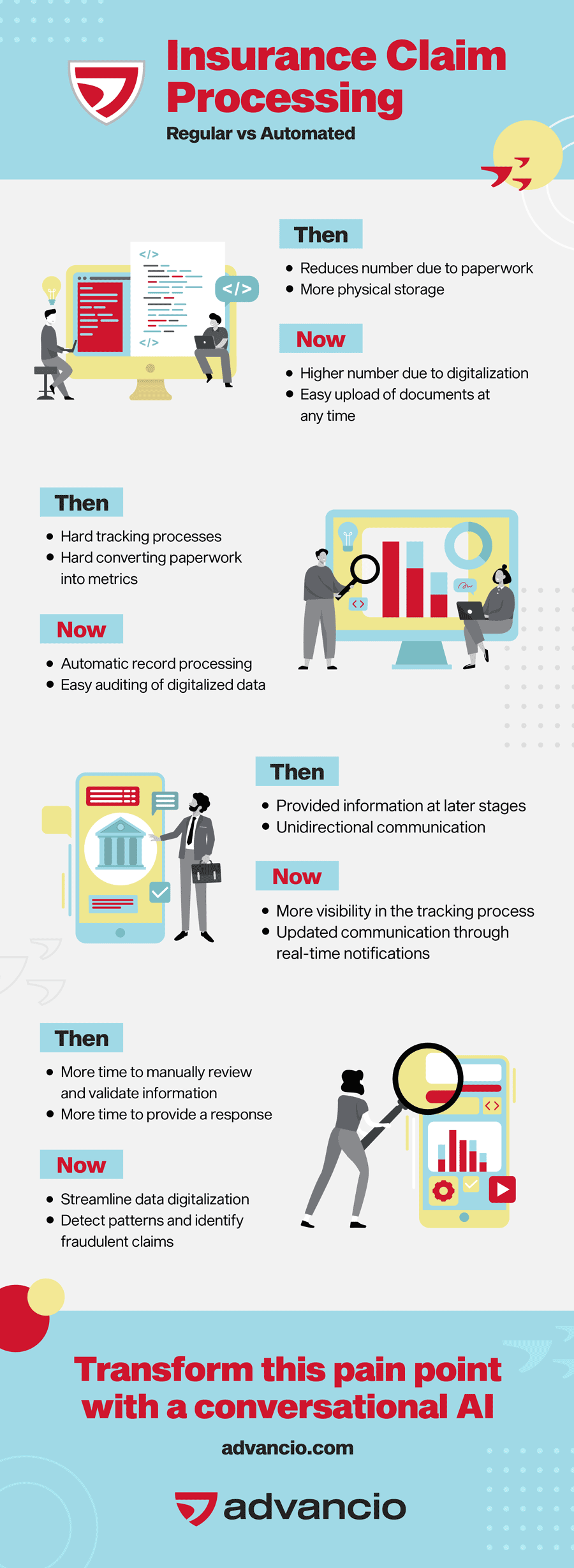

Regular Vs. Automated Insurance Claim Processing

In the past, some insurance processes were manually handled. This slows down the progression of claim processing from the first notice to the settlement and payment arrangement. But with more advanced implementations, you can complete these stages in less time and in an automated manner. Here are some major differences between the regular approach and the virtual assistant to take into consideration. If you need it, you can also Hire BPO Services.

Data entry

In regular claim processing, there’s a reduced number of data entries due to paperwork alongside more physical storage. In contrast, automation streamlines processes and gives you the option to upload electronic formats at any time.

Audit

While tracking processes and converting paperwork into metrics was harder in the past, now with power virtual agents, you have automatic record processing and easy auditing of your data.

Visibility

Another important aspect to mention is the customer experience in terms of information access, tracking, and screen performance. In an old-fashioned model, it is more common for the client to request information at later stages of the transaction. But in an automated world, the customer will have more visibility in the process, tracking more information and updates in real-time through notifications sent through different channels.

Validation

With a lot of paperwork to check, insurers will no doubt take more time to manually review, validate the information, and provide a proper response. That’s when a conversational AI is the perfect tool to streamline processes. This includes data digitalization, detecting patterns, and identifying fraudulent claims while continuously learning about them through its AI predictive models.

Infographic Design By Advancio.

How Conversational AI Processes Claims

- First claim notice: the client reports a claim and makes a data entry with evidence. Then the power virtual agents start processing the information at any time.

- Claim validation: the conversational AI tracks data patterns from the provided information to assess the damage, validate, and review the potential for fraudulent claims. Human agents also review this process. If the tool discovers a blocker or error in the claim, it will immediately pass it on to the agent. If it doesn’t, it simply eases the review process and makes it easier to verify the claim.

- Policy review: once the validation is complete, the virtual agents review the client’s policy coverage based on their damage evaluation. In this process, experts intervene to suggest various courses of action to solve the problem and to adjust assessments accordingly.

- Claim resolution: then, the applicable deductible is determined, and the claim resolution is automatically notified to the customer.

- Payment and final arrangements: the client decides on the action and can make payments through the conversational AI quickly.

It is important to note that during claims processing, you can configure your virtual agents to automatically notify your clients about all steps and update them on claims status.

What to Consider for Implementing Conversational AI

By its nature, claims processing workflow is slow and can be slower given some errors as well as the type of notified claims. However, this tool is ideal for optimizing this pain point and modernizing other involved processes.

As an insurance provider, you must consider that sometimes your claim processing might have weaknesses due to regulatory misunderstandings. This means that your business unit and local providers should be on the same wavelength throughout the process, giving you the most look-alike interpretations to move forward on them or, at least, don’t delay or complicate them. We also suggest counting on a subject matter expert to better understand regulations and efficiently resolve claims.

Given that power virtual agents collect more data than regular information channels and tools and analyze it more quickly, you can convert critical parts of the customer journey into insights.

On the one hand, this could potentially lead to offering more options to clients as well as more customized options not only for dealing with claims, but also for policy coverage. On the second hand, through conversational AI, it is possible to make claims in anticipation of failures and make suggestions to clients about repairs, maintenance, or other activities that could lead to a future claim.

When taking advantage of what a virtual assistant is, it is likely that your IT infrastructure needs some adjustments because it has the right technology and accurate process management. This will lead to gaining data-driven insights, better understanding your processes, and managing client expectations. In turn, you will scale up claim processing in a faster manner by identifying the needed infrastructure and resources and implementing the consequent actions you take to ensure that your claims are properly processed.

Try Conversational AI

With virtual agents, you can not only enhance client communication with quality, efficient and transparent responses in less time, but also in other business areas. This will increase business productivity and profitability while also gathering information and analyzing data for better decision-making.

Different types of automated tools can be implemented based on your type of insurance company and their needs. A conversational AI is about interpreting data and moving rapidly forward in the processes. Would you like to implement it in your business? Contact us!